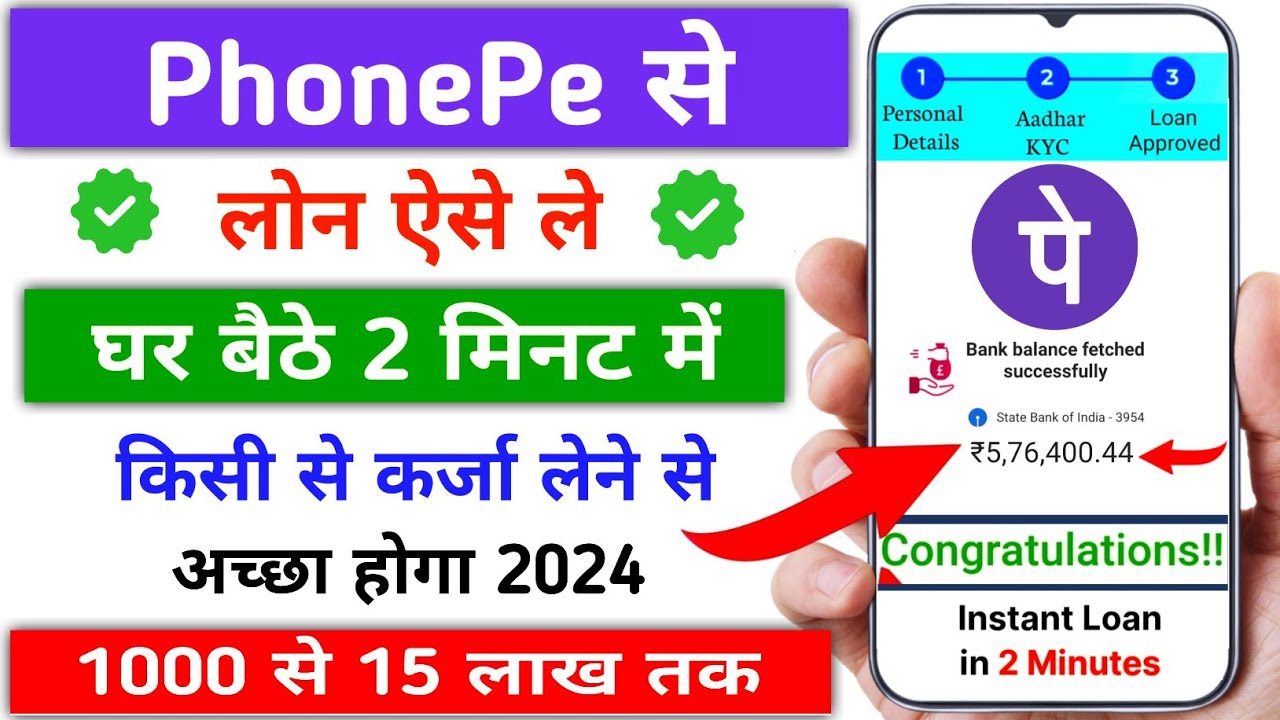

Phonepe Loan Online Apply – PhonePe is helping its customers by giving loans through third parties, whose interest rates can range from 15% to 26%, but the loan can be taken only if your credit score is good, otherwise PhonePe does not give you the loan.

Phonepe Loan Online Apply Kaise Kare

In this article, we will learn how to take a loan from PhonePe what documents are required whether it will be eligible, and what will be the interest rates.

Phonepe Loan Eligibility Criteria

-

Applicant must be Indian and above 18 years of age.

-

PhonePe must be installed on the applicant’s smartphone.

-

He should have a good credit score so that the application can be approved.

-

The applicant should not be a defaulter by any bank or financial company.

-

Applicant’s salary should be above Rs 15 thousand.

Phonepe Loan Document Required

To take a loan from PhonePe, I have mentioned some documents that you need while applying for the loan.

For Self-employed Person

-

Identity Proof: PAN Card/Voter ID/Driving License/Passport

-

Income Proof: Latest salary slip/Form 16/last 6 months account statement audited/ITR returns for the last 2 years

-

Address Proof: Landline Bill/Electricity Bill/Ration Card/Voter ID/Passport

-

Other related documents: Check-off letter from employed

For Un-Employed Person

-

Identity Proof: PAN Card/Voter ID/Driving License/Passport

-

Income Proof: Latest salary slip/Form 16/last 6 months account statement audited/ITR returns for the last 2 years

-

Address Proof: Landline Bill/Electricity Bill/Ration Card/Voter ID/Passport

-

Other related documents: Check-off letter from employed

PhonePe Loan Online Apply Details

| Loan Provider Name | Phonepe |

| Loan Type | Instant Personal Loan |

| Interest Rate | 15% to 28% |

| Eligibility | You must already have a PhonePe account. |

| Maximum loan amount | Rs 5 lakhs |

PhonePe Loan Repayment Process

Once you have taken a loan, you have to repay the loan on time, if you are unable to do so then you may have to pay a penalty. However, you can pay the loan amount in installments also.

Phonepe Loan Online Apply By Youtube Video

Phonepe Loan Customer Care Number

If you want to contact PhonePe’s Customer Service Center for information related to any payment-related issues, then you will have to visit the Customer Portal which is on the PhonePe App.

| PhonePe Customer Care No. | 080-6872 7374 |

| TOLL FREE NUMBER(S): | 1800 102 1482 (Ethics Helpline) |

| ALL INDIA NUMBER(S): | 080-6872 7374022-6872 7374 |

Phonepe Loan Apply Features and Benefits

- Nil prepayment charges.

- Good customer service.

- Quick and easy loan approval.

- Special schemes

- and discounts to existing employers.

- No hidden costs

- Minimum documentation

- Loan eligibility can be increased subject to the terms and conditions.

- Lowest EMI

- Provides personal loans for people belonging to a wide age group from 21 to 58 years.

- Low processing fees.

- High loan amounts.

How to Online Apply for Phonepe Loan

All the information to apply for the loan from PhonePe is given below, by following it you can take a loan from PhonePe.

PhonePe has started this loan-giving service for a long time. They have started this instant loan service for the convenience of Phonepe users. With its help, you can easily take a loan for yourself, that too through PhonePe App.

- To take a loan through the app, first of all, you have to download the PhonePe App from the Play Store.

- You can Download Phonepe From Google Play Store via the link

- After installing this app, you have to register in this app with your mobile number.

- After that, to take the loan, you have to link your bank account on the PhonePe App through UPI ID so that the money will come to your account.

- Now you have to go to PhonePe and select My Money.

- After that, you can easily take a loan through the PhonePe third-party app.

- In this way, you will easily get loans online.

Disclaimer

We do not 100% confirm the information given on the page, therefore the reader is requested to collect information from the official website of the company for which he wants to avail the facility.

FAQ

Q. What is the age limit for a PhonePe loan?

Once you have completed the application and the lending partner approves the loan, it may take up to 48 hours for the loan amount to be credited to your Account.

Q. Does PhonePe offer loans?

PhonePe also offers a loan facility to its users, through which they can avail of loans from PhonePe.

Conclusion

I hope you have liked my article on how to take a loan from PhonePe. After reading this, you would have easily understood the important information about how to get a PhonePe loan. It is always my endeavor to provide complete information about the loan to the readers so that they do not need to search for that article on any other sites or the internet.

This will also save them time and they will get all the information in one place. If you have any doubts in your mind regarding this article or you want that there should be some improvement in it, then you can write comments below.

If you liked this article What Documents Required for PhonePe Loan or learned something, then please share this post on social networks like Facebook, Twitter, and other social media sites.