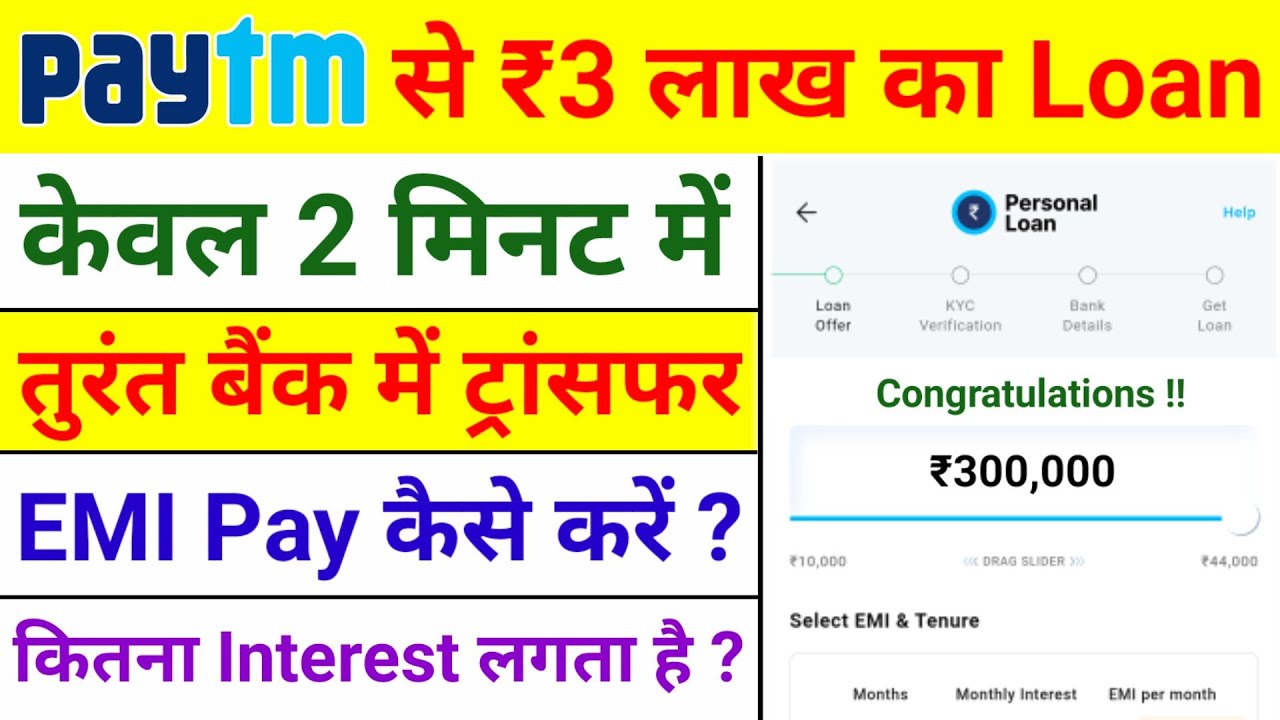

Paytm Se Loan Kaise Le; Paytm offers loans to customers whose interest rate ranges from 10% to 18%, and the process of taking the loan is online. You need some documents like a PAN card and Aadhar card, and for eKYC, a mobile number linked to Aadhar and a photo is clicked.

- 8 Facts About Lightstream Personal Loan

- Sofi Personal Loan Apply

- Biden canceled student loans, know the reason

Paytm Se Loan Kaise Le

In today’s time, whenever we need money, we either borrow from a friend or relative or take a loan from the bank, which takes a lot of time, like 3 to 10 days.

Apart from this, if you take a loan from the Paytm Application, then you can get a lot of benefits from it and it can also save a lot of time, which is available in a very short time and at a very low interest rate. Let us know about it in detail –

Paytm Loan Eligibility Criteria

- Applicant must be an Indian citizen and at least 18 years of age.

- Paytm must be installed on the applicant’s mobile

- The salary of the applicant should be more than Rs 15 thousand.

- Apart from this, the credit score of the applicant should be good

- and there should not be any kind of loan pending or default.

Paytm Loan Type

I want to make one thing clear Although there is no direct option to take a loan on Paytm, you can take a loan from here through a third party.

Step 1 – For this, first of all, you have to open the Paytm application.

Step 2 – After this, banners and advertisements of many loans will be visible through which you can

You can take a loan from a third party through Paytm. Through this application, many companies provide loan offers to people like Navi Loan App, KreditBee Loan App, etc. With their help, you can easily take a loan. In all these, different applications determine eligibility differently.

Paytm Loan Interest Rate – How Much

If you take a loan from Paytm from any third-party app, then the interest rate you will have to pay for it ranges from 10% to 29%, but if you want more information then you will get to know from the same third-party app only. Information about the interest rate will be given on whichever application you take the loan from.

Apart from this, there is another method with the help of which you can also take a loan from Flipkart. Although you cannot take any loan from Paytm, you can take a direct personal loan from Flipkart. If Paytm recommends Flipkart App, then Flipkart pays advertisement fees to Paytm.

Paytm Loan Emi Calculator

Paytm provides the facility to its customers to calculate the loan so that the customer can easily calculate his loan amount.

Calculator link click here

Paytm Loan And Credit Card Partner

Our partner NBFCs/Banks provide loans/ credit cards on the Paytm app.

- HDFC Bank

- State Bank Of India

- Piramal Private Finance Limited

- Tata Capital

- SMFG India Credit

- Aditya Birla Capital

- Shriram Finance

- Hero Fincorp

- CLX

- Axis Bank

- Poonawalla Fincorp

- Muthoot Fincorp

What documents will be required for the Paytm loan? (Paytm Se Loan Kaise Le)

I have shared below the information about the documents for both employed and non-employed.

For Self-employed Person

- Identity Proof: PAN Card/Voter ID/Driving License/Passport

- Income Proof: Latest salary slip/Form 16/last 6 months account statement audited/ITR returns for the last 2 years

- Address Proof: Landline Bill/Electricity Bill/Ration Card/Voter ID/Passport

- Other related documents: Check-off letter from employed

For Un-Employed Person

- Identity Proof: PAN Card/Voter ID/Driving License/Passport

- Income Proof: Latest salary slip/Form 16/last 6 months account statement audited/ITR returns for the last 2 years

- Address Proof: Landline Bill/Electricity Bill/Ration Card/Voter ID/Passport

- Other related documents: Check-off letter from employed

Highlights of Paytm Loan

| Interest Rate | 10% to 29% |

| Loan Amount | Up to Rs. 20 Lakhs |

| Minimum income required | Rs. 15,000 |

| Loan Tenure | Up to 6 years |

| Processing Fees | As per Company Policy |

Features and Benefits of Paytm Loan (Paytm Se Loan Kaise Le)

- Nil prepayment charges.

- Good customer service.

- Quick and easy loan approval.

- Special schemes

- and discounts to existing employers.

- No hidden costs

- Minimum documentation

- Loan eligibility can be increased subject to the terms and conditions.

- Lowest EMI

- Provides personal loans for people belonging to a wide age group from 21 to 58 years.

- Low processing fees.

- High loan amounts.

Paytm Se Loan Kaise Le Apply Online

All the information to apply for a Paytm loan is given below, you can take the loan by following it.

According to the information given here, you will be able to easily get a loan so that you can fulfill your needs and get it without interest.

- To take a loan through the app, first of all, you have to download the Paytm App from the Play Store.

- You can Download Paytm From this link

- After installing this app, you have to register in this app with your mobile number.

- After that, to take the loan, you have to link your bank account on the Paytm App through UPI ID so that the money will come to your account.

- Now you have to go to Paytm and select My Money.

- After that, you can easily take a loan through the Paytm third-party app.

- In this way, you will easily get loans online.

Conclusion

Paytm Se Loan Kaise Le, information is given in this article. If you liked reading then please share it with your friends and on social media platforms.

Disclaimer

We do not 100% confirm the information given on the page, therefore the reader is requested to collect information from the official website of the company for which he wants to avail the facility.

FAQ

Q 1. Paytm Loan online

A. Yes You can Paytm loan Online through the Paytm App

Q 2. Does Paytm offer loans?

A. Paytm also offers a loan facility to its users, through which they can avail of loans from Paytm.